Remember US Crude Exports are Cyclical

Peak average daily exports probably already in

A big story last week was the supposedly sudden surge to US daily crude exports, which were pushing the 6 million barrels per day threshold. Based on industry fundamentals, most importantly US rig counts, exports at this level look cyclical, not sudden.

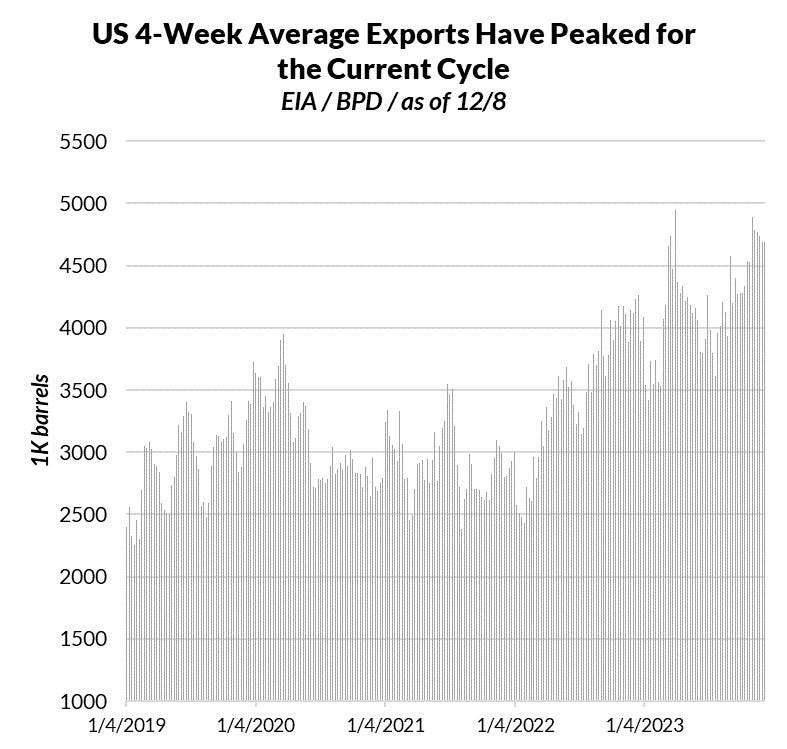

This cyclical component was absent from coverage from most major financial media outlets. As is clear in the chart below, US average daily crude exports have been rising steadily since early 2022 to historically high levels. This also includes total daily production, which has surpassed 13 million bpd, some of which has been dumped by traders as part of seasonal destocking. This has also taken timespreads for US crude to historically low levels of ~0.30 (WTI M1-M4) and fed worries about a supply glut in 2024.

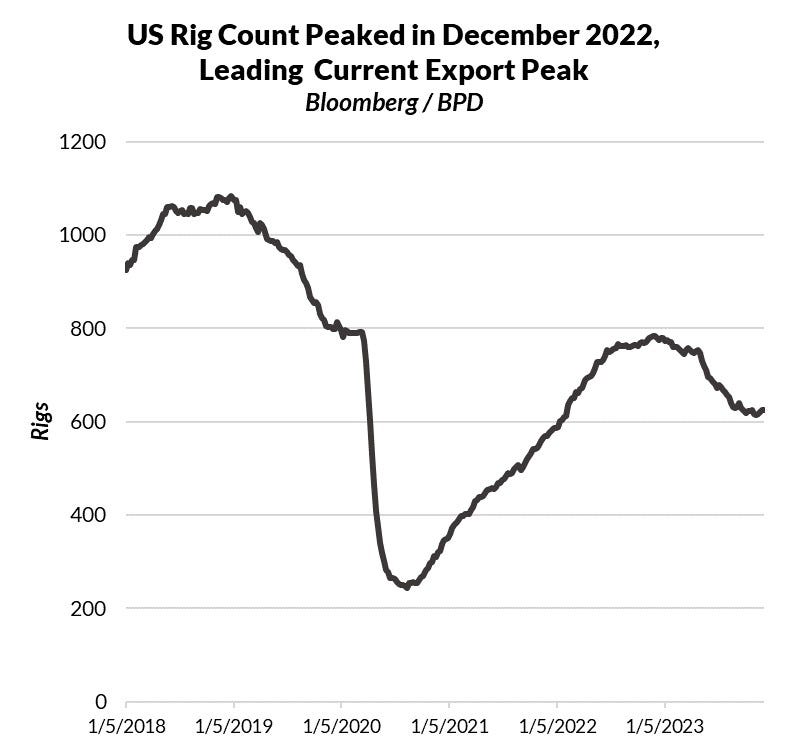

What has been missed, however, is the cyclicality of US crude exports. Among other factors, this is a function of rig counts, the basic unit of potential output. Based on historical relationships, US rig counts lead US crude exports by ~50 weeks. With this relationship in mind, it is no surprise that US rig counts began to increase sharply in early 2021, peaking in December 2022. Run this last data point forward, and it should come as no surprise that US exports have been increasing throughout 2023, to what look like peak levels in the present.

This implies that barring other factors, US crude exports should fall steadily throughout 2024, with the potential for a reduction to daily exports of 1 million barrels or more by the end of 2024. On this basis excess contango in the WTI curve looks questionable. At current levels of interest rates and low forward prices, it is unlikely that 2024 will see a sharp increase to US rig counts.

In addition to the significance for expected demand-supply balances in 2024, these estimates for US average daily exports are also highly relevant to the nature and strength of the relationship between crude prices and the USD. When US crude exports remain above the 4 million bpd threshold, they contribute to dollar strength and a positive relationship with crude prices. When they fall below this threshold, the relationship becomes more neutral and the petro-currency like behavior evaporates. Dollar weakness aside, relatively strong base effects in the energy complex from 2023 and forward expectations of weaker crude prices in 2024 point to an additional source of disinflationary pressure in the US. This, along with what this implies for the Fed rate cycle, is a dollar negative factor.